Learning Center

5 Tips for New and Confused QuickBooks Users

Brand new to QuickBooks? Or just struggling with it? Here are five things you can do to get more comfortable with the software.

Learning new software is always a challenge. You have to learn the lay of the land before you can start working with it. How do I do this? How does the menu system work? How can I enter data without making a mistake?

The learning process for financial software for your small business can be especially unnerving. Your livelihood depends on getting everything right. A mistake in an invoice you’re creating is more serious than using incorrect grammar or punctuation in a letter.

We recommend that you let us give you a good introduction to QuickBooks, so you get the program set up correctly and learn the most basic, often-used functions. In the meantime, here are five things you can do to start getting your feet wet.

Familiarize yourself with QuickBooks’ lists

You’ll consult and use lists a lot in QuickBooks. Transaction forms offer access to data you’ve already created and will use. When you need to select a customer, for example, you can just open a drop-down list and click on one.

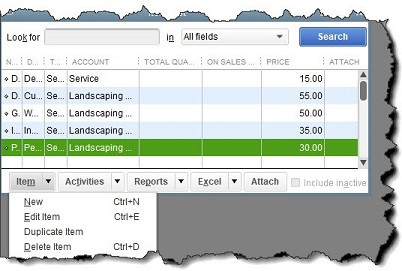

QuickBooks also provides free-standing lists that you might need to use outside of transactions, though they’re often available there, too. Open the Lists menu to see them. They include Item List, Sales Tax Code List, and Class List. Click on one to open it, and you’ll see a series of menus running across the bottom of the window. They allow you to, for example, add or edit items, take actions like entering a sales receipt, and run related reports.

The Item List

Troubleshoot transactions

What do you do when you know you’ve entered a transaction but you can’t find it? QuickBooks has good search tools, but sometimes you don’t have enough details to hunt effectively for the missing invoice, bill, etc. There are two reports that can help.

It’s possible that the transaction you’re seeking was accidentally voided or deleted. Open the Reports menu and select Accountant & Taxes | Voided/Deleted Transactions Summary or Detail. If you have an idea of when the original transaction was entered, change the date range at the top of the screen. You really shouldn’t have many of these. If you do, let us help you determine why this is happening so frequently. You can get into some trouble if you void or delete transactions to solve a problem that should be resolved another way.

While you’re in the Accountant & Taxes report list, open the Audit Trail. This is a listing of transactions that have been entered or modified, when, and by whom. If you have multiple users accessing and working with QuickBooks data, you should get to know this report.

Work with windows

Every time you open a window in QuickBooks, it stays open. You can always close it by clicking the X in the upper right corner of the window – not the program X in the farthest upper right corner. If you have a lot of windows open, all of that clicking can become tiresome.

Open the Window menu to see your options there. You’ll see a list of all the windows that are open. Click on one to go there. You can also “tile” the windows vertically or horizontally so they overlap each other on the screen or “cascade” them, which places them on top of each other with only the window label showing. And you can close all of them at once by clicking Close All.

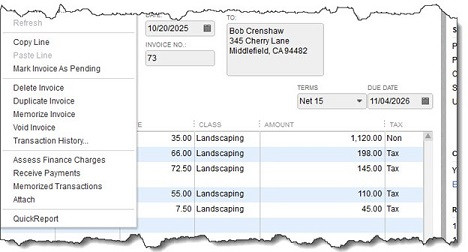

Use “local” menus

Most QuickBooks windows provide ways for you to take a related action. But most also offer “local” menus, or right-click menus. Open an invoice form to see how this works (Customers | Customer Center | Transactions | Invoices). Right click in the header of the invoice. Your menu options here include:

Duplicate Invoice

Memorize Invoice

Transaction History, and

Receive Payments.

You’ll also find these commands and more in the toolbar at the top of the window.

A local menu in an invoice

Practice with a QuickBooks sample file

Before you start entering real data in QuickBooks, or if you’ve already done so and you want to try out a new feature without risking an error, use one of QuickBooks’ sample files. That’s why they’re there.

You can open one of these when you’re loading QuickBooks. You’ll see a window labeled No Company Open. Click the arrow in the box on the lower right that says Open a sample file. You can choose between a product- and service-based business.

Once you’re in QuickBooks, you can switch back and forth between your company file and a sample file by opening the File menu. Click Open Previous Company and select from the list. It should be obvious, but be sure you’re in the correct QuickBooks file before doing anything.

How’s It Going?

If you’ve been using QuickBooks for a while, how are you doing with it? Are you struggling with any functions? Feeling like you’re not using as much of the software as you should? Thinking that you’re outgrowing it and need to move up to a more senior version? Or are you having a hard time upgrading to QuickBooks 2023? We can help in all of these situations. Contact us, and we can set up a meeting or a series of them to make your accounting experience more productive and effective, and faster.

NEVER MISS A STORY.

Sign up for our newsletters and get our articles delivered right to your inbox.

Rose Tax & Financial

Cedar Crest, New Mexico 87008

Sat: 10:00am to 2:00pm

Check the background of your financial professional on FINRA's BrokerCheck

Avantax affiliated Financial Professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment Services℠, Member FINRA, SIPC, Investment Advisory services offered through Avantax Advisory ServicesSM, Insurance services offered through an Avantax affiliated insurance agency. 3200 Olympus Blvd., Suite 100, Dallas, TX 75019. 972-870-6000.

The Avantax family of companies exclusively provide financial products and services through its financial representatives. Although Avantax Wealth Management® does not provide or supervise tax or accounting services, Avantax representatives may offer these services through their independent outside business. Content, links, and some material within this website may have been created by a third party for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth Management® or its subsidiaries. Avantax Wealth Management® is not responsible for and does not control, adopt, or endorse any content contained on any third party website.

This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

The information being provided is strictly as a courtesy. When you link to any of the web sites provided here, you are leaving this web site. We make no representation as to the completeness or accuracy of information provided at these web sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences.

For Important Information and Form CRS please visit https://www.avantax.com/disclosures.