Learning Center

Planning Your IRA Strategy

Your IRA Contribution Options

For over 40 years, individuals have been able to set up personal retirement plans called individual retirement accounts (IRAs). Nearly everyone who receives “compensation,” either as an employee or as a self-employed individual, can contribute to an IRA. You can choose from a variety of different types; some give you a tax deduction, while others don’t. This article highlights in general terms the IRA options available under current law and points out some of the advantages of each. For more details about which IRAs fit best with your specific situation, please call this office.

Setting up an IRA: To select the best type of IRA to meet your current income level and your long-term investment goals generally requires the advice of a professional. You are strongly advised to seek the advice of this office before selecting a specific type of IRA and the investment vehicle for your IRA. Although others, not fully cognizant of your current tax planning objectives or your long-range financial and estate planning needs, will be eager to assist you, prudent planning may be more appropriate.

Types of Investments: Examples of typical IRA investment vehicles include insurance annuities, stocks, bonds, mutual funds and cash (in savings institutions or brokerage accounts).

Definition of Compensation: You can open and contribute to an IRA only if you receive “compensation.” Compensation includes wages, salaries, tips, professional fees, commissions, self-employment income and taxable alimony. Compensation does not include rental income, interest or dividend income, pensions or annuities, deferred compensation, or amounts that are excluded from income.

IRA Penalties

Remember that various penalties can apply to most IRAs. When you contribute more than the IRA limits allow, withdraw from the account too early, or don’t take sufficient distributions when required, penalties can apply. Under certain circumstances, penalties can be avoided for premature IRA withdrawals. Exceptions apply, for example, when withdrawal is due to disability, for paying certain first-time home purchase expenses, and for paying educational costs. Be sure to check with this office concerning the exact rules on penalties to ensure against receiving unwelcome “surprises” when filing your tax return.

Tradiitional IRAs

With a Traditional IRA, if you’re under age 70, you can contribute up to the annual limit to your IRA account. However, if your taxable compensation is less than the annual limit in a given year, your contribution will be limited to the amount of your compensation.

Traditional IRA contributions are generally deductible on your tax return. However, one can designate them as nondeductible. If this choice is made, you build up a basis in your IRA so that part of each withdrawal is nontaxable when you start making withdrawals from the account. However, the choice not to deduct an IRA contribution should be made with caution in light of your particular tax situation.

If you’re married, file jointly, and your spouse has little or no compensation, a Traditional IRA may be set up as a spousal IRA, allowing your spouse to make IRA contributions based upon your compensation. However, neither spouse can deposit more than the annual limit to his/her individual account.

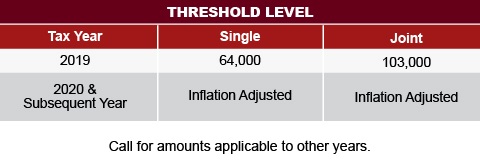

Participation in Other Plans: One complication of Traditional IRAs affects taxpayers who actively participate in other retirement plans – e.g., an employer plan, a Keogh or SEP, etc. When you are covered by another retirement plan, your IRA deduction “phases out” (i.e., gradually reduces to zero) depending on your filing status and your income level. Phase-out begins at income levels according to the following schedule:

*The Single threshold applies to taxpayers other than those filing joint, except Married Separate taxpayers who have a threshold of $ -0- .

If a taxpayer’s income exceeds the above thresholds by less than $10,000 ($20,000 for joint filers), his or her IRA deduction will be limited; if it exceeds the threshold by $10,000 ($20,000 for joint filers), there is no IRA deduction.

Break for Spouse of an Active Participant: The limits on deductible IRA contributions do not apply to the spouse of an active participant. Instead, the maximum deductible IRA contributions for an individual who is not an active participant but whose spouse is an active participant, is phased out for the nonactive individual if the couple’s combined AGI is within the phase-out range for the year.

Due Date for Making Traditional IRA Contributions: Traditional IRA contributions (whether deductible or nondeductible) must be made by the due date (without extensions) of the return for the year to which they apply.

Roth IRAs

You may be able to open a Roth IRA, a type of IRA that allows only nondeductible contributions. Distributions from these IRAs, including earnings on them, are tax-free if a holding period and other requirements are met. Like the Traditional IRA, annual contributions are limited to the smaller of your compensation or the annual limit. However, if you have other IRAs – for example, a Traditional IRA – your combined annual contributions to all of them (including the Roth IRAs) can’t be more than the annual contribution limit. Roth IRAs allow contributions even after you turn age 70, and spousal Roth IRAs are also allowed. The due date for making your contributions to a Roth IRA is the same as for Traditional IRAs.

Contributions to Roth IRAs phase out if income is within the phase-out range for the year (may differ from the traditional IRA phase-out range). The phase-out applies regardless of whether the taxpayer (or spouse, if married) is an active participant in another plan.

Rollovers: There is no AGI limitation for making Traditional IRA to Roth IRA conversions. When you roll over or convert to a Roth IRA, you must pay tax on the income from the Traditional IRA that would have been taxed if it had not been converted to a Roth IRA.

Comparing Results of Traditional and Roth IRAs: Determining whether a Traditional IRA or a Roth IRA best suits you depends upon your unique circumstances, both now and in the future. You are encouraged to consult with this office to assist you with this decision.

Qualified Roth Contribution Plans

Some employer-qualified retirement plans offer employees the option of contributing their elective 401(k) or 403(b) plan contributions to a separate designated Roth account. These are commonly referred to as Roth 401(k) or Roth 403(b) plans. Do not confuse these accounts with a Roth IRA.

These accounts are governed by the qualified pension plan rules and allow contributions up to the “elective deferral” limit for the year (the employer’s matching contribution cannot be made to the designated Roth portion of the account). For 2019, the “elective deferral” limit is $19,000 ($25,000 if age 50 or over). The limit is adjusted periodically for inflation. Do not confuse these limits with Traditional and Roth IRA contributions limits which are determined separately.

Unlike IRAs, distributions from a Qualified Roth Contribution Plan are generally only permitted when the participant terminates employment, dies, becomes disabled or reaches age 59. These accounts are subject to a separate 5-year aging rule and can be rolled over into a Roth IRA. They are also subject to required minimum distributions at age 70 unless rolled into a Roth IRA prior to reaching age 70.

Annual Contribution Limits

The IRA contribution annual limit slowly rose over the years as a result of specified increases in the law, but has leveled off recently because of low inflation rates. In addition to normal contributions, taxpayers age 50 and older are allowed to make “catch-up” contributions allowing them larger contributions in their later years to fund their approaching retirement needs. The table that follows illustrates the annual contribution limit applicable by age for Traditional and Roth IRAs.

Saver’s Credit: The Retirement Savings Contribution Credit, frequently referred to as the Saver’s Credit, was established to encourage low- to-moderate-income taxpayers to put funds away for their retirement.

Up to $2,000 per taxpayer of contributions to an IRA (Traditional or Roth) or other retirement plans, such as a 401(k), may be eligible for a nonrefundable tax credit that ranges from 10% to 50% of the contribution, depending on the taxpayer’s income. The maximum credit per person is $1,000. The contribution amount on which the credit is based is reduced if the taxpayer (or spouse if filing jointly) received a taxable retirement plan distribution for the year for which the credit is claimed (including up to the return extended due date in the following year) or in the prior two years. If the modified AGI exceeds $32,500(1) (single and married separate), $64,000(1) (married joint) or$48,000(1) (head of household), no credit is allowed. An individual who is under age 18, a full-time student, or a dependent of someone else is ineligible. The credit is in addition to any deduction allowed for traditional IRA contributions.

(1) These rates are inflation adjusted annually and the rates shown are for 2019.

Coverdell Education Savings Accounts: Originally referred to as Education IRAs, a Coverdell Education Savings Accounts (CESA) are actually nondeductible education savings accounts, not IRAs. The investment earnings from these accounts accrue and are withdrawn tax-free, provided the proceeds are used to pay qualified education expenses of the beneficiary. Contributions are only allowed for designated beneficiaries under the age of 18. The allowable nondeductible contribution is $2,000 per year per beneficiary.

The annual contribution limit is gradually reduced if the contributing taxpayer’s “modified AGI” is within the phase-out range and eliminated for taxpayers above the range.

The phase-out limits for married taxpayers are $190,000 – $220,000 and $95,000 – $110,000 for single taxpayers.

If the AGI limits the contribution, the funds can be gifted to someone else whose contribution would not be AGI limited, even the beneficiary.

The advice included in this article is not intended or written by this practitioner to be used, and it cannot be used by a practitioner or taxpayer, for the purpose of avoiding penalties that may be imposed on the practitioner or taxpayer.

NEVER MISS A STORY.

Sign up for our newsletters and get our articles delivered right to your inbox.

Rose Tax & Financial

Cedar Crest, New Mexico 87008

Sat: 10:00am to 2:00pm

Check the background of your financial professional on FINRA's BrokerCheck

Avantax affiliated Financial Professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment Services℠, Member FINRA, SIPC, Investment Advisory services offered through Avantax Advisory ServicesSM, Insurance services offered through an Avantax affiliated insurance agency. 3200 Olympus Blvd., Suite 100, Dallas, TX 75019. 972-870-6000.

The Avantax family of companies exclusively provide financial products and services through its financial representatives. Although Avantax Wealth Management® does not provide or supervise tax or accounting services, Avantax representatives may offer these services through their independent outside business. Content, links, and some material within this website may have been created by a third party for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth Management® or its subsidiaries. Avantax Wealth Management® is not responsible for and does not control, adopt, or endorse any content contained on any third party website.

This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

The information being provided is strictly as a courtesy. When you link to any of the web sites provided here, you are leaving this web site. We make no representation as to the completeness or accuracy of information provided at these web sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences.

For Important Information and Form CRS please visit https://www.avantax.com/disclosures.