Learning Center

Simplify Your Business With Recurring Transactions In QuickBooks Online

QuickBooks Online offers a world-class set of bookkeeping and accounting features designed to simplify financial management tasks for all business owners. Among these features is the ability to set up recurring transactions. This powerful, time-saving tool is a great way to automate certain expenses and payments.

Whether you're using QuickBooks Online or QuickBooks Desktop, recurring transactions can help you streamline your day-to-day financial processes. In this guide, we'll explore how to make the most of recurring transactions in the QuickBooks Online system.

QuickBooks Online: Mastering Recurring Transactions

Recurring transactions in QuickBooks Online are invaluable for businesses that have regular monthly expenses – note that bills are not eligible for the recurring transactions feature, however. By setting up recurring templates for certain costs, business owners can automate the process, ensuring they never miss a payment. Additionally, QuickBooks Online's recurring transactions are ideal for businesses with subscription-based revenue models. This makes it simple for proprietors to effortlessly create recurring invoices, saving time and preventing late payments from subscribers.

Creating Recurring Templates

Access Your Settings: Log in to your QuickBooks Online account and navigate to the Settings ⚙ menu.

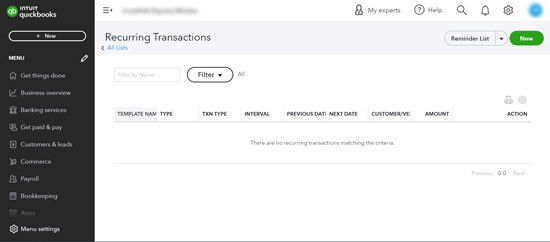

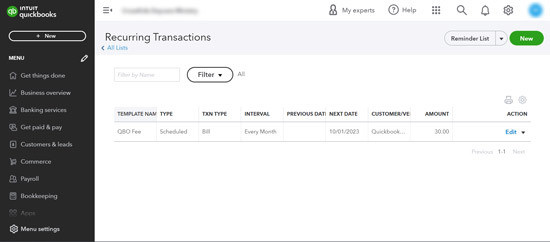

Select Recurring Transactions: In the Settings menu, locate and select "Recurring Transactions."

Create a New Template: To create a new recurring template, click on "New."

Choose Transaction Type: Select the type of transaction you want to make recurring. QuickBooks Online allows you to create templates for various transaction types, except for bill payments and time activities. Once selected, click "OK."

Name Your Template: Give your template a descriptive name to easily identify it.

Specify the Type: Choose the template type: Scheduled, Unscheduled, or Reminder. Your choice depends on the nature of the transaction and when you want it to recur.

Complete the Template: Fill in all the necessary fields for the transaction. This includes details like the payee or customer, items or services involved, and any other relevant information.

Save the Template: Once you've completed the template, save it. Your recurring transaction is now set up and ready to automate your financial processes.

Duplicating Existing Templates

QuickBooks Online also allows users to expedite the template creation process by duplicating existing templates. Here's how:

Access Settings: Again, navigate to the Settings ⚙ menu.

Select Recurring Transactions: Click on "Recurring Transactions."

Choose a Template: From your list of recurring templates, select the one you want to duplicate.

Duplicate the Template: In the Action column dropdown menu, choose "Duplicate." The duplicate copy will inherit all settings from the original template, except for the title.

Edit as Needed: Customize the duplicated template by editing fields, making adjustments, or adding new details.

Save the Duplicate: Save your duplicated template, and it's ready to use.

Harnessing the power of recurring transactions in QuickBooks Online can significantly simplify your financial management tasks. By automating routine transactions and reducing manual data entry, you'll save valuable time and reduce the risk of errors in your financial records. Whether you're managing your personal finances or handling accounting for your business, QuickBooks' recurring transactions feature is a valuable tool that can streamline your financial processes and contribute to your overall efficiency.

NEVER MISS A STORY.

Sign up for our newsletters and get our articles delivered right to your inbox.

Rose Tax & Financial

Cedar Crest, New Mexico 87008

Sat: 10:00am to 2:00pm

Check the background of your financial professional on FINRA's BrokerCheck

Avantax affiliated Financial Professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment Services℠, Member FINRA, SIPC, Investment Advisory services offered through Avantax Advisory ServicesSM, Insurance services offered through an Avantax affiliated insurance agency. 3200 Olympus Blvd., Suite 100, Dallas, TX 75019. 972-870-6000.

The Avantax family of companies exclusively provide financial products and services through its financial representatives. Although Avantax Wealth Management® does not provide or supervise tax or accounting services, Avantax representatives may offer these services through their independent outside business. Content, links, and some material within this website may have been created by a third party for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth Management® or its subsidiaries. Avantax Wealth Management® is not responsible for and does not control, adopt, or endorse any content contained on any third party website.

This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

The information being provided is strictly as a courtesy. When you link to any of the web sites provided here, you are leaving this web site. We make no representation as to the completeness or accuracy of information provided at these web sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences.

For Important Information and Form CRS please visit https://www.avantax.com/disclosures.