Learning Center

Streamline Your Business Finances: QuickBooks Online Fund Recording Tips

As the business world becomes increasingly competitive – and increasingly digital – it is essential to maintain meticulous financial tracking and accurate recording of all incoming funds. QuickBooks Online (QBO) is an excellent resource for small business owners who are looking to do their recordkeeping in the cloud. Whether you're receiving payments for invoices, documenting instant sales, or conducting business on the go, the platform equips you with the tools you need to ensure that all of your income is correctly recorded.

Delayed Payments

If your business involves sending invoices for products or services, QBO offers multiple ways to record payments when they come in. You can opt to open the invoice directly and click on the "Receive payment" option in the upper right corner. However, accessing the "All Sales" screen provides an opportunity to review the status of other pending transactions. To navigate to this screen, click on "Sales" in the toolbar, then select "All Sales."

For those with extensive lists of sales transactions, using the Filter tool can streamline the process. Click on the down arrow next to "Filter" in the upper left to explore your search options (e.g., Status, Customer).

Once you've located the correct invoice, navigate to the bottom of that row. In the "Action" column, you'll find the "Receive payment" option. Feel free to explore other available choices by clicking on the down arrow. When the "Receive Payment" window appears, specify the applicable payment method, leave the "Deposit to" field set to "Undeposited Funds," and double-check that all information is accurate. You can print the receipt or add attachments using the provided links, then save it.

Pro Tip: Offering customers the option to make online payments tends to expedite the invoice settlement process.

Instant Payments

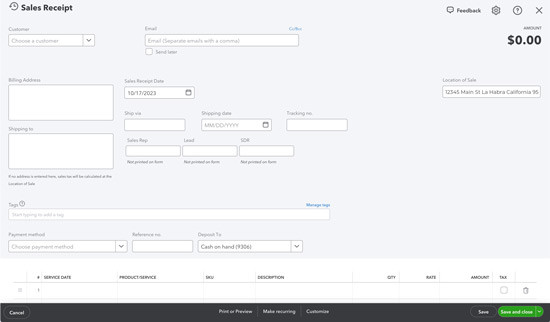

In situations where your business receives payments at the time of product or service delivery, issuing a sales receipt – rather than an invoice – is the way to go. this is also essential for your records. Simply click on the "+New" button in the upper left and select "Sales receipt" under Customers to open a blank form. You'll fill it out in a manner similar to creating an invoice. Start by selecting the customer and proceed to input or select any necessary data for the remaining fields.

If you find yourself not needing all the fields on your sales forms, don't hesitate to remove some or add custom ones. The beauty of QBO is that you can make it work for your company.

Going Mobile

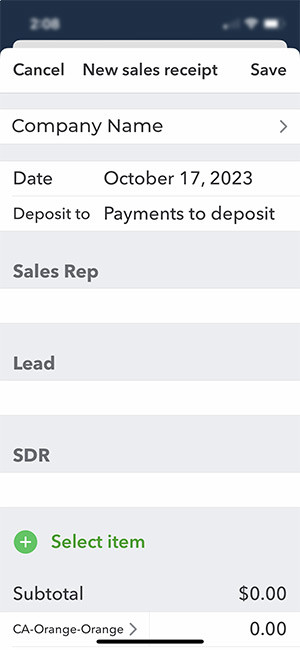

For those who conduct business on the go, the QuickBooks mobile app makes it simple for users to create sales receipts for your customers. By clicking on the plus (+) sign at the bottom of the screen and selecting "Sales Receipt," you can access a form similar to what you'd use on your desktop computer. The layout may differ, but the form's functionality remains intact.

Having a QuickBooks Payments account is especially helpful when you're making mobile sales. You can even accept credit and debit card payments by ordering a card reader directly from Intuit.

Accurate payment recording is always essential. Nowadays, with the IRS cracking down and business regulations changing all the time, it's more critical than ever to ensure that every dollar is accounted for. QuickBooks online allows you to become a more confident business owner.

NEVER MISS A STORY.

Sign up for our newsletters and get our articles delivered right to your inbox.

Rose Tax & Financial

Cedar Crest, New Mexico 87008

Sat: 10:00am to 2:00pm

Check the background of your financial professional on FINRA's BrokerCheck

Avantax affiliated Financial Professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment Services℠, Member FINRA, SIPC, Investment Advisory services offered through Avantax Advisory ServicesSM, Insurance services offered through an Avantax affiliated insurance agency. 3200 Olympus Blvd., Suite 100, Dallas, TX 75019. 972-870-6000.

The Avantax family of companies exclusively provide financial products and services through its financial representatives. Although Avantax Wealth Management® does not provide or supervise tax or accounting services, Avantax representatives may offer these services through their independent outside business. Content, links, and some material within this website may have been created by a third party for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth Management® or its subsidiaries. Avantax Wealth Management® is not responsible for and does not control, adopt, or endorse any content contained on any third party website.

This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

The information being provided is strictly as a courtesy. When you link to any of the web sites provided here, you are leaving this web site. We make no representation as to the completeness or accuracy of information provided at these web sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences.

For Important Information and Form CRS please visit https://www.avantax.com/disclosures.